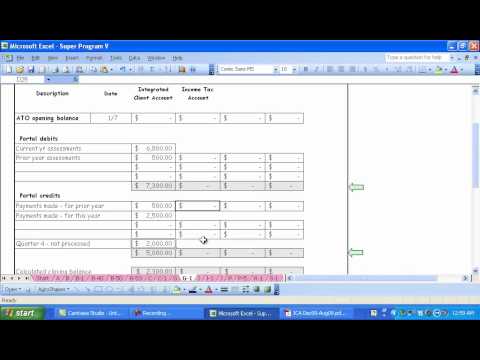

Scheduled G1 is the reconciliation of the integrated account with the ATO and the income tax account. You'll notice that there's a column for the integrated account and a second column for the income tax account. If there was a balance carried forward from a previous year, it would have been recorded automatically here. However, in many cases, the balance is zero. The figures in the integrated account come from Schedule G and reflect the entries made for the current year assessments. For the prior year assessments, the figure is $5,800. These figures appear as a transaction because even though they relate to the previous period, they are processed by the ATO in the current period. Portal credits refer to payments made for the prior year that are processed in the current year, as well as payments made in the current year for the current year. The best Northcott ABN, which is included in Schedule GIA, has not yet been processed by the ATO. Therefore, it is reflected in the portal reconciliation. The income tax account mainly consists of the assessment of the prior year's tax and the payment of that tax. The new contacts account only requires the entry of the prior year assessment and the payment of that tax in the current year. After entering all these transactions, you need to determine the closing balance of the integrated account for the year. This can be a little tricky as the integrated accounts often have confusing dates and a running balance. However, you can estimate the effective closing balance, which in this case is $11,249. If the closing balance differs from the calculated amount, it needs to be explained. The schedule allows for flexibility, but any differences must be accounted for.

Award-winning PDF software

990 - Schedule G Form: What You Should Know

Form 990 and Schedule G: How to Report Funerals — Federal Election Commission The federal election commission requires that you collect and report in a timely fashion any disbursements to your candidate for Federal office from your organization's funds. This allows for the complete and accurate reporting of contributions made to your campaign. Any amount received from an organization after the organization completes the election cycle may be reported on Schedule B of Form 990-EZ and on the Form 990-N if you file Form 990. Form 990-N. U.S. Department of the Treasury. Internal Revenue Service. Form 990-N. Form 990-C, Schedule P Federal campaign finance regulations require that you report the name, address and occupation of each individual to which you make a contribution or transfer or that you authorize an agent to give. Note: Schedule P also includes contributions received from the Federal government as well as other contributions. Schedule P. U.S. Department of the Treasury. Internal Revenue Service. Form 990-C, Schedule P. Schedule PP. U.S. Department of the Treasury. Internal Revenue Service. Form 990-PP. (Schedule P also includes contributions received from the Federal government as well as other contributions.). Schedule P (Form 990-C) for U.S. Federal Government Exempt Organizations — U.S. Department of the Treasury The IRS requires organizations that receive 600,000 or more in contributions from individuals each year to report the name and mailing address for their Federal Identification Number (known as a “PIN”) on Form 990-C. Form 990-C will be filed with the IRS on paper or electronically and should be attached to the organization's Form 990-N. The form is available online at and will also appear on IRS Forms 1065 and 1095-B. Schedule A. U.S. Department of the Treasury.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 990 - Schedule G, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 990 - Schedule G online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 990 - Schedule G by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 990 - Schedule G from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 990 - Schedule G